In this Issue: This year’s “Most Influential Buyers” share their thoughts on what’s trending in technology, which products they’re seeking out, and how they make purchasing decisions. Then, we review Elon Musk’s upcoming Starlink satellite Internet service, and canvass retailers to discuss how they’re getting around the chip shortage. And don’t miss our eight-page Health & Wellness special, where we cover everything from Beauty Tech to the FDA’s process for approving health gadgets.

We Help You Look Your Best!

Whenever I go to the electronics and department stores, I am always surprised to see how many new Health and Beauty items retailers have in their mixes — items that will make sure customers are trim and that their pulses are on point, as well as tech to keep them young, fit, and beautiful. This category is here to stay. So it’s with pleasure that we introduce our section on “Health and Beauty” tech. Read through this specialized content to see why this category is becoming a retailer’s staple.

In this issue, we also celebrate the “Most Influential Buyers” at retail. These honorees are the cream of the crop; make sure that you check out their profiles. Giles Sutton, Interim Co-CEO, CEDIA, writes an excellent and thorough piece on how dealers can and must help their customers integrate smart appliances into the connected home. Be sure to also read “5 Things to Listen for When Auditioning a Soundbar System,” where you can see what is important to the consumer in this audio category.

On the international scene, we look at SHIFT, the mobility area of IFA, and what is planned for September in Berlin. Here we will learn about the thought leaders in every element of mobility. The Future is here.

Lastly, we welcome an addition to the CT Lab family. Erinn Loucks is now Chief Editor for our sister publication, Connected Design. She comes from the NKBA’s magazine. Erinn will also be a monthly contributor to Dealerscope. In August, she will give us a preview of probably the first in-person show many of us will attend this year: CEDIA Expo. I look forward to seeing many of you there in Indy.

As always, please feel free to get in touch with me at tmonteleone@ctlab.media.

Tony Monteleone, Publisher

A WORD FROM OUR EDITOR IN CHIEF

Travel is Back: Do You Know where Your CE Accessories are?

From higher airline prices and sold-out hotels to long lines for hikes at National Parks, the signs that travel is back are everywhere. According to a recent report by Coresight Research, 62 percent of U.S. consumers surveyed said they planned to travel domestically through the end of September. (Interestingly, only 7.4 percent said they planned to travel internationally, which suggests that travel restrictions are still hampering that market.)

Leisure travel aside, the return of in-person industry events — CEDIA, CES, Web Summit — suggests an uptick in business travel as well. No surprise, considering that 65 percent of business travelers surveyed considered in-person events extremely important and 67 percent found virtual events to be less valuable than in-person events, according to Parks Associates.

All this serves as a boon to airport-, hotel-, and resort-retailers, which have suffered tremendously during last year’s pandemic-induced drop in travel. According to Coresight Research, gift, novelty, and souvenir stores suffered a massive 80 percent drop in sales year-over-year in April, but have since rebounded to near-2019 levels, while sales at airport retailers, specifically, dropped more than 60 percent year-over-year. The report estimated that airport retail sales will grow by $10 billion this year versus last year. It’s no wonder that airport CE retail chain InMotion announced in July that it plans to open 18 stores in U.K. airports, as well as expanding the InMotion brand to hotels, resorts, and casinos in the United States.

Not all headphones, power banks, charging cables, and mini-Bluetooth speakers are purchased “planeside” after travelers go through security, however. And since the bulk of this year’s expected travel will be domestic, it’s likely that the transport method of the day will be by car, and that the gadgets and accessories that U.S. consumers bring along on the voyage will be of the road-trip-friendly variety.

If you’re an independent retailer, that means making sure that you have that new pair of noise-canceling cans or smartwatch in stock. Given the chip shortage and the ensuing challenges around procuring products, any store that has what consumers want right now will have an immediate edge. This strategy is “key” to success in today’s competitive CE retail landscape, according to DataVision CEO and Founder Jimmy Garson, whom we interview in this month’s “Retail on the Run.” As he tells it, providing a quick turnaround for sales and repairs is one of the reasons his business continues to thrive after 31 years.

One last thing: As the tech correspondent at Travel + Leisure for nearly a decade, I had the privilege of putting the latest travel-friendly gadgets through their paces month after month. While my voyaging over the 18 months has been limited to two coast-to-coast flights and four long-weekend road trips, I still keep a running list of my favorite travel gadgets. At the moment, the top three I never leave home without are: the Jabra 85t noise-canceling earbuds (seamless pairing, stellar sound-blocking); the Acer Swift 5 laptop (super slim and small 14-inch Full HD screen that gives serious bang for the size and weighs just 2.29 pounds); and the Elecom CapClip travel mouse (this ingenious hors d’oeuvre-sized Bluetooth mouse is small enough to fit on an airplane tray table and comes with a clip case to attach to your laptop screen). As I head out to industry events in the coming months, I’ll be taking notes on the electronics I bring with me. Make sure to watch this space, where I’ll continually share my portable picks.

Tom Samiljan

INTERNATIONAL PERSPECTIVES

Future Format

The 2021 SHIFT Mobility convention debuts

as an in-person, mixed reality event.

BY PHILIPP SOHMER

SHIFT Mobility, the annual conference and industry pow-wow that focuses on next-gen transportation, will run as planned on September 2nd and 3rd as an in-person event in Berlin, but with an intriguing and cutting-edge twist as a mixed reality convention far beyond the traditional trade fair.

“Mobility is changing fast, [and] the way we talk about it, too,” says Hans H. Hamer, CEO of SHIFT Mobility. He and his team have tackled the challenges of COVID-19 by launching this groundbreaking new format. From a mixed reality studio in Berlin, SHIFT will visit the coolest brands, the fastest thinkers, the most innovative startups and operate simultaneously as a physical and digital global event. Renowned experts such as Andreas Loeschel (advisor on energy transformation for the German Government and IPCC), Andrew DeWit from Rikkyo University Tokyo, and Scot Wingo (Forbes Technology Council) are among those mobility experts who will present either in Berlin or virtually. Speakers will share insights on topics such as sustainable mobility, software-defined vehicles, and new dimensions of transport.

“It has never been more important to talk about the future of mobility,” says Hamer, who has positioned SHIFT Mobility as the up-and-coming brand over the past couple of years. Despite the challenges of running an event over the past year and a half, Hamer has been adamant that the 2021 SHIFT Mobility conference take place as planned, and has found ways to expand the platform throughout the year. His strategy has been to set up a timeline with more boutique satellite events in Hamburg and Tel Aviv later this year, as well as integrations with CES and SxSW in 2022.

In recent years, SHIFT Mobility has assembled inspiring thinkers and doers such as Renzo Vitale (BMW Group), Michael Lohscheller (Opel), François Bausch (Deputy Prime Minister of Luxembourg), and many others in Berlin. These experts have not only discussed the most fascinating and promising trends in transportation, but have also critically reflected on the big picture around the transformation of society through sustainable mobility and living.

“The transition to renewable energy and mobility is bigger than the Industrial Revolution,“ says Auke Hoekstra, the director of ZenMo Simulations, who will speak at SHIFT this year. Hoekstra is one of the leading thinkers regarding electromobility, and epitomizes the spirit and the motivation behind SHIFT. For this reason, there will also be a focus on renewable energy and new urbanism this year, with the overall headline of the conference being “mobility meets tech.”

TRADE SHOWS

CEDIA Expo Returns With New Programming Features

The residential technology show is set

for this September in Indianapolis.

BY ERINN LOUCKS

(Main Image) At Booth #4344, Leon Speakers is launching the Terra LuminSound TrLs50 — a revamped version of its Ls10 outdoor speaker with a new exterior design and six new finish options.

After taking place virtually in 2020, CEDIA Expo is due to return in person September 1–3 at the Indiana Convention Center. The show will bring together more than 10,000 technology integrators, designers, and construction professionals, and include more than 300 exhibitors.

This year, the show will build on existing elements along with introducing several new programs. The CEDIA Expo Smart Stage is one of the returning features, serving as the home for 17 panel discussions, programs, and award ceremonies. Topics include wellness, business intelligence, and multi-family housing solutions.

Formerly called Innovation Alley, the Launchpad highlights brands that have been in business less than three years and have not exhibited at CEDIA Expo before. The Launchpad exhibitors are automatically entered into the TechStarter program, where brands will pitch products and services for a chance to be chosen as a “TechStarter FIVE.”

Also debuting at the show is the Innovation Hub, a programming venue showcasing case studies — particularly on ‘resimercial’ projects — through 25 sessions across three days. Topics will include home theater, lighting, work from home, and security — all areas that have grown in relevance recently.

“It’s hard to believe, but we’re closing in on two years since the last in-person CEDIA Expo and now — more than ever — we know there’s a need for community, connection, and getting back to business,” said Jason McGraw, Emerald Group vice president, CEDIA Expo & the Kitchen and Bath Industry Show (KBIS). “We’re all eager to connect again on a human level and get back to face-to-face events as we celebrate everything we value as a community together again.”

Returning brands will offer game-changing products and essential networking for attendees. The PowerHouse Alliance, at Booth #4207, will offer an opportunity for its members, vendors, and dealers to connect. SurgeX has plans to showcase its power protection and conditioning equipment at Booth #4149 to demonstrate the value and importance of a solid power foundation. At Booth #4344, Leon Speakers is launching the Terra LuminSound TrLs50 — a revamped version of its Ls10 outdoor speaker with a new exterior design and six new finish options.

Companies debuting at CEDIA include PantryOn at Booth #3035, an automated kitchen pantry that organizes and monitors inventory via an app and notifies homeowners when products need replenishing. Also showing at Booth #2735 is Guard Dog Solutions, an AI-powered network security system, and at Booth #2729, Orro is presenting a human-centric smart lighting system.

CEDIA Expo 2021 registration is open now for attendees and exhibitors.

MOST INFLUENTIAL BUYERS

Dealerscope’s 2021 Most Influential Buyers

COMPILED BY NANCY KLOSEK

Like a train, the consumer technology field constantly races forward at a breakneck pace. The great minds and companies that spark innovation rarely take a moment’s rest. Buyers are the conductors of the consumer technology train. By keeping their finger on the industry’s pulse to find new products, models, and vendors, they provide it with direction.

The 2021 Dealerscope Influential Buyers Awards seeks to put a spotlight on these tireless individuals who possess the vast relationship network and foresight necessary to act as trendsetters within the consumer technology field. Nominated by their peers, these eight buyers are being recognized not only for their familiarity with technology, but also for their outstanding connections with others in the industry. We have asked our honorees to share with us their buying philosophies, and additional insights from their time in the business. The profiles you will be reading on them provide an invaluable look into the methods of their success. Congratulations to all the 2021 honorees!

Joe Feregrino,

Electronics Buyer,

Nebraska

Furniture Mart

Career History:

Joe Feregrino’s career in retail began 15 years ago at NFM where he started as an administrator in the buying department. Today, as an Electronics Buyer at NFM, he oversees the Home Audio and Portable Audio categories. He manages the merchandising and buying decisions, store presentations and marketing strategy for all locations, including the web. He is also a board member on the CTA Audio Division Board, and a member of the ProSource Audio Committee.

He says that what has kept him engaged and involved in the industry is “the people that I meet and relationships I have built, as well as the committee and board I sit on… I have always had an appreciation for music and movies, but being in the audio industry has really elevated my appreciation and turned it into a passion. It excites me to see and experience all of the latest and greatest products and technologies!”

Buying/Business Philosophy:

“Everything begins and ends with the customer.

“[My job’s high points include] the collaboration with vendor partners that share my passion for the audio industry. The success we have had collaborating on new products, displays, marketing plans and merchandising gives me great satisfaction. Together, we help customers improve their lifestyles.

“Cultivating strong vendor partnerships and collaboration is key. I keep an open mind to new items and ideas, while also visualizing the long-term potential and impact of a brand and its products. I share my goals and expectations so all involved understand how we can partner together and define success. Staying actively involved, providing suggestions, and giving regular feedback to my vendor partners on how we can improve is essential to achieving strong results. I am committed to the success of not only my categories, but also of my vendor partners through our mutually beneficial programs and partnerships.”

Anton Gouws,

Senior Buyer –

Consumer Electronics,

Makro South Africa

Career History:

Anton Gouws has 23 years’ experience in Consumer Electronics, having held various positions in retail operations (Sales – Management); after 11 years he became a buyer. In the last 13 years, he has been a buyer for Audio Equipment, Headphones, Navigation, Wearable Tech, Networking Equipment. Action Cameras, CCTV, Streaming Devices, Drones, Smart Home Automation and Thermometers. “My focus remains on Innovation and connectivity,” he says. He is currently the Consumer Electronics Product Specialist Buyer Makro SA (Division of Massmart South Africa powered by Walmart International).

Buying Philosophy:

“My novelty-seeking personality drives my need for innovation and to remain up to date with the latest international trends and domestic market needs. I focus on building interpersonal relationships with my supply chain on a solid foundation of trust. I have remained engaged in this sector due to the excitement it has to offer and the solutions to make people live better. In order to be a market leader you have to offer consumers differentiation, remain innovative and competitive and focus on win–win, profitable relationships to achieve the goals of the organization and your own objectives. The most rewarding experiences for a buyer is to see the joy on consumers’ faces when they use your innovative products. Delivering on customer centricity and creating a brand with supplier-partners are rewards in themselves. I am passionate, goal-oriented, determined and loyal. I also believe that you have to engage with everyone, as consumers, suppliers and forum speakers can educate you. To be successful as a buyer, you have to persevere even under all conditions, and find products that offer consumers solutions. I work closely with my suppliers during the difficult times and to find alternative, trend-based products to achieve our financial goals and overcome adversity.”

Danielle Gray,

Buyer,

D&H Distributing

Career History:

Danielle Gray has been in the retail consumer electronics industry for more than a decade, joining D&H in one of the company’s distribution centers. She understands the industry from all angles, having gone full circle, from loading products to buying products, providing her with a broad perspective on the inner workings of the industry. Danielle quickly rose to a position as an assistant buyer, and later, to full-fledged buyer, applying her intellect and personability to create strong, long-term relationships with manufacturers — relationships that she says are her favorite part of the business. She currently drives key retail categories including televisions, flat-panel displays, and home and portable audio, which have grown year-over-year. That’s in addition to areas of future opportunity, such as power protection, cables, and surveillance/security, which ensure that remote home environments can meet the simultaneous business and entertainment demands of a post-COVID-19 world.

Buying/Business Philosophy:

Danielle’s supervisors rave about the dedication she’s shown to her positions, which has helped to build her sharp insights into the supply chain. She understands and successfully executes on departmental and company goals and metrics, treating each strategic vendor relationship with care and analytical precision, immersing herself in the details of her accounts down to the SKU level. She is self-motivated, detail-oriented, and gracious in welcoming collaborative input. D&H’s leadership says it feels lucky to have her as part of the team.

From Danielle: “I truly enjoy the people that I work with, both at D&H and within the vendor community, which leads me to understand this dynamic industry better every day. I’ve seen people move from company to company, yet the relationships I’ve established have moved with them, bringing fresh ideas and new investments to D&H as our partners evolve. Building those relationships is the core function of my job, and it’s what I love best about it.”

Kim Jacobsen,

Senior Buyer,

Nebraska Furniture Mart,

Omaha

Career History:

Currently, Kim Jacobsen is the Senior Buyer for the TV category, but NFM has been her home for 20 years. With an Interior Design background and education, Kim’s career started in the Master Bedroom category of the Furniture division, then later pivoted to Business. She says, “After holding a variety of positions, working alongside some of the best in their respective industries, I have realized that the absolute best education and experience I could hope for has come from the rich history and culture of the people of NFM.”

Buying Philosophy:

“I made my home in electronics, ironically, the most unexpected and uncomfortable place I could think to be and create a career. But 20 years later, I can’t imagine being anywhere else. The fast pace creates an energy that is exciting, and though it has challenges, overcoming [them] is rewarding. Often, I’m in awe of having a front-row seat to the innovation happening right in front of my eyes.

“Personally, I have an unconventional style and a knack for testing my boundaries, but I believe that ability to push the envelope is what has made me successful. It requires a bit of tenacity, resiliency and adaptability but it’s encouraging to be allowed to think big and always strive to be and do better. There is a restlessness to never be complacent and always strive for higher expectations.

“The biggest thing that keeps me coming back are the relationships I have built across the industry, with my NFM teammates and my Vendors partnerships. No one person can be successful without the support of their team, and I’m fortunate to have a great team, supportive vendors, and to work for an amazing company.

“NFM is a great place to collaborate and to innovate, and I am proud of the many successes we have had, from marketing, merchandising, product showcases and events over the years, and am excited to continue partnering to improve customers’ lifestyles.”

PJ Orsini,

Owner,

Orsini’s

Career History:

PJ Orsini is the third-generation principal of a 73-year-old independent home store. Orsini purchased the business in 2016 from his family, and in 2019 moved into an 18,000-square-foot location with an 8,200-square-foot showroom, expanding from an appliance store into a complete home specialty store. “I am the third generation in my business,” he says, “and we have expanded from an appliance store into a home center, offering cabinets, countertops, bedding, flooring, outdoor living products, and much more. I enjoy being the catalyst of evolution in our business model, and we work hard to keep ahead of trends both within the industry and from consumer behaviors.”

Buying/Business Philosophy:

“‘Create the demand for what is on hand.’ This applies both to my sales team as well as to how I need to diversify our product offerings and flooring strategies. I do not believe in having a set floor model mix, as there are too many external variables that challenge a fixed set. So [I belive in] being nimble enough to change the product selections based on what the manufacturer inventory allocation allows.

“[My job’s high points include] surviving and thriving during the COVID pandemic. I was very proud to see the relationships we have cultivated with our manufacturers, Nationwide Marketing Group, and our professional partners, which allowed us to become COVID-ready in a very short time. I was able to create a great virtual experience online for the consumer that was safe and effective, while navigating through the inventory allocation issues we are all experiencing.

“[What makes me an effective buyer is that] I don’t believe anyone will out-work me. I am constantly looking at consumer buying trends, industry statistics, and using that info to create a go-to-market buying strategy that is supported by consumer buying habits and patterns. I also look at the very successful independent retailers in my industry, along with associated products and some industries that have nothing to do with the home, but are iconic within their own markets, to see what they are doing to stay on top as well as what they are doing to be in front of what is coming next.”

Paul Roth,

Director

of Merchandising,

BrandSource

Career History:

For the first 10 years of Paul Roth’s career, he worked for a national retailer, “where I learned the fundamentals of retailing/purchasing and broadened my skill set. It has been over the last 12 years, however, when I made a move to the independent side of the retail Industry, that my career really took off. My current role, working on the buying side for independent retailers here at BrandSource, affords me the opportunity to continue to grow as a buyer.”

Buying Philosophy:

“Independent retail buyers like myself have a broad scope of responsibilities that include relationships, purchasing, marketing, leadership, merchandising, logistics, etc. Due to the streamlined structure of independent retail organizations, I have worn many hats and have made a significant impact in the success of many businesses. Assisting independent retailers gives me the honor of helping others achieve the American dream by running a profitable business.

“I have been truly humbled to play a part in the bottom-line success of so many businesses I have been associated with. I look forward adapting to an ever-evolving marketplace, and to continue to elevate my game as my employment journey unfolds.”

Tyler Scherner,

Director of Purchasing,

DAS Companies, Inc.

Career History:

Tyler Scherner is DAS Copmanies, Inc.’s Director of Purchasing. He oversees a team of nine, collectively managing several categories within DAS, including consumer electronics, consumables, and toys. “Having a great team is everything, and I am very proud of mine,” he says. “While I have a comfort level in multiple categories, consumer electronics is my passion! It has been a constant area of responsibility throughout my career, and I still love the challenge. Things are constantly evolving, and it takes a continuous effort to keep up.”

Buying/Business Philosophy:

“Three things come to mind, when trying to define my buying style.

“First, I do not believe in keeping things status quo, ever. Success is planned. I have several categories that are having record sales years in 2021; but even with successful categories, it is critical to be strategic and forward-thinking. Record sales in 2021 means there is going to be a ton of pressure to keep setting records in 2022. As such, it is vital to always have one eye on the future.

“Second, this is a relationship business, and I believe in those relationships being genuine. For success to be truly achieved, all parties must be winning. As such, I try to see the point of view of others, and then I develop my game plan accordingly.

“Third is my willingness to take calculated risks. Every decision I made is strategic, and I try to look at all the possible angles. I am an imperfect person, and not every decision I make is going to be correct; so, the key is to maximize the wins, and to minimize the losses. Sounds stupid simple, because it is, but it is a step that not everyone takes. Some people are seemingly taken off-guard when something does not perform as expected, and then everything they do is reactionary to that fact. My focus is to be proactive, and to have already planned for every possible scenario, as opposed to being reactionary.”

Cassaundra Wertman,

Senior Buyer,

Almo Corporation

Career History:

Cassaundra (Cassie) Wertman works on Almo’s New Product Development Team and is responsible for sourcing products that Almo directly imports into the U.S. and sells under private-label brands, handling everything from purchasing to forecasting to marketing.

She attended Towson University and graduated with a Bachelor of Science degree in Business Administration and Marketing. Before Almo, she was Project Coordinator at US Construction and in charge of managing site work, coordinating material deliveries, approving invoices, and scheduling subcontractor work.

Buying Philosophy:

Cassie excels in all areas of her role – her energy and excitement are infectious and her talent is limitless. She is responsible for a number of categories — the largest being outdoor furniture — and has played a successful, integral role in all of them. She is also handles outdoor heaters, electronic fireplaces and even sheds, chicken coops, dog houses, and bunny hutches, which are sold online through Almo’s E-Commerce Fulfillment Division and through various dealer channels.

From Cassie: “I work closely with suppliers — it’s critical to have a strong relationship with open and honest conversations about the market, the trends and the influencers. I want to make sure we are capitalizing on attracting all the right buyers to our products. It’s also important to partner with companies that provide the highest-quality products, including top craftmanship, and the best materials that are easy to assemble and long-lasting.

“I have a passion for outdoor furniture and one of my greatest achievements at Almo was growing this business area exponentially throughout the pandemic. I was also able to add the outdoor steel shed category to our Almo offering, which has grown to become a million-dollar business over the last year.

“My buying philosophy is truly an extension of Almo’s way of doing business, and that’s focusing on people and relationships first. It boils down to taking the time to cultivate partner relationships and go the extra mile. Additionally, as we’ve all learned over the last year, it’s important to be nimble and adaptable, because product situations are fluid and can change at a moment’s notice.”

AUGMENTED REALITY

How To Solve Consumer Problems With AR

Augmented reality can improve the customer experience and create brand awareness, but advancing the technology requires a collaborative approach.

BY DAVID XING, FOUNDER, PLOTT

Plott’s Carta is a digital measuring and mapping wheel that can create blueprints of a space from 2D images.

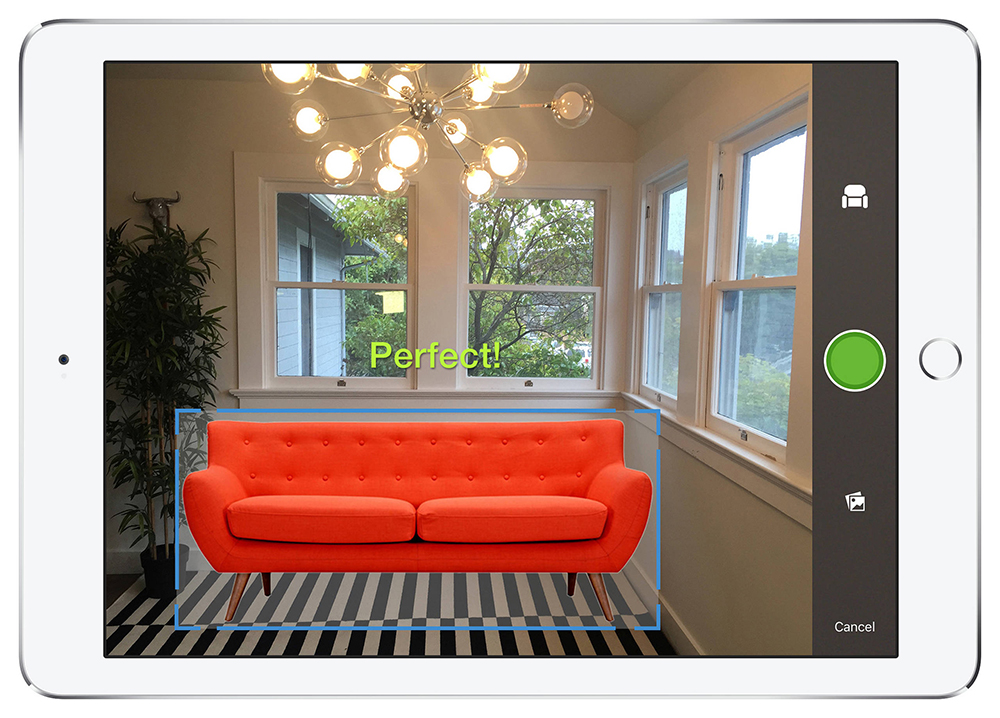

Five years ago, augmented reality (AR) entered the mainstream via phone-based applications. Despite mainstream hits such as Pokemon Go, which was a rudimentary workaround compared to today’s implementations, AR in general struggled with slow adoption and education hurdles. Even as the early hype subsided, retailers looked for practical use cases for AR, realizing that it had the potential to increase sales conversion by enabling consumers to see how a product or experience — furniture, clothing, consumer electronics — would look in the context of a home or other real-world setting.

Today, we’re at the beginning of a new golden age of technology. AR, AI, Edge Computing, 5G — it’s all converging. Amid rapid changes, the key to integrating technology into retail in ways that drive sales is to focus on constants.

Trends come and go, but the biggest consumer problems remain constant. The AR industry’s value proposition also remains constant: We help people see things that don’t yet exist and bring “the promise” to life.

Seeing Instead of Imagining

In a 2019 Nielsen global survey, consumers listed augmented and virtual reality as the top technologies they’d want to assist them in their daily lives, and just over half (51 percent) said they’d use the technology to assess products.

“Try before you buy” is the most practical and immediate solution AR offers.

Virtual try-before-you-buy experiences skyrocketed during COVID-19. These visualizations range from previewing furniture in your home from brands such as Wayfair and Home Depot to testing what fashion, glasses, or even makeup will look like when worn. MAC Cosmetics shared that the demand for its virtual try-ons feature online has tripled since the pandemic began, pushing forward years of innovation and adoption of AR within retail in a matter of just a few months.

When consumers see something rather than just imagine how it could be, they’re much more likely to engage with it, vastly improving ROI. Shopify released data showing that products featuring AR content saw a 94 percent higher conversion rate than products without it. Similarly, Houzz reported that people who engaged with their AR tool were 11 times more likely to purchase, and spent nearly three times more time in the app.

At Plott, the extended reality (XR) company I founded, we use AR technology to seamlessly take users from conceptualizing to designing to completing DIY projects. For example, consumers can overlay a picture frame they like on their own space via the phone viewfinder, then purchase it, and then utilize our integrated hardware and indoor measuring solution, Cubit, to guide them as to precisely where and how to hang it on the wall. Similarly, our digital measuring and mapping wheel, Carta, can help complete similar tasks outdoors and on a larger scale.

Plott’s Cubit uses AR to help you measure, design, and create indoor spaces, or just where to hang art on a wall.

Delivering Brand Awareness

Another consumer problem AR helps solve is making buying decisions. In a crowded (and sometimes copycat) market, it can be difficult to choose one product or experience over another. Often, the brands who win are the ones who know how to stand out.

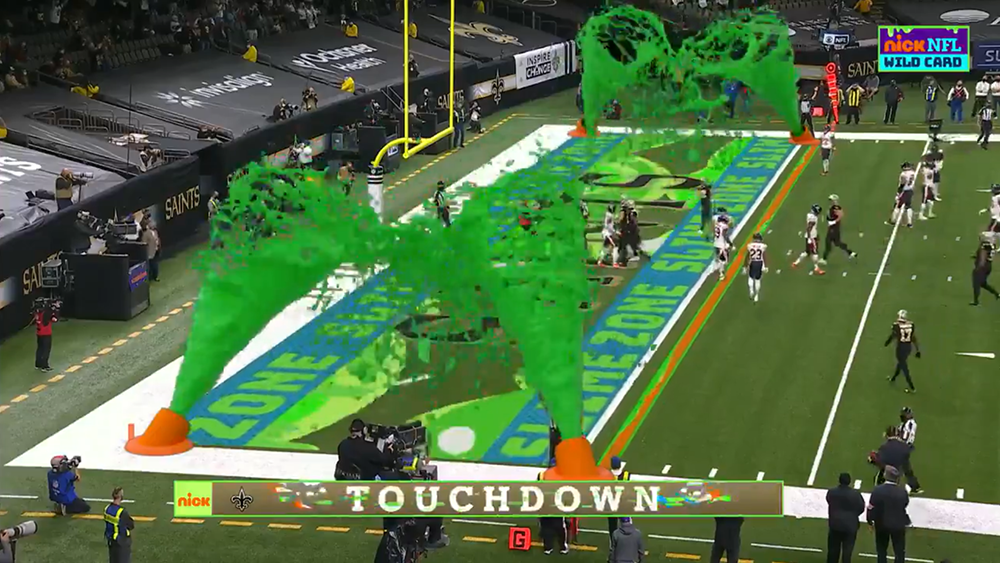

In one example, the NFL recently partnered with Nickelodeon to bring some of the channel’s signature slime to the football field virtually, maximizing the co-viewing appeal for families. In another, BON V!V Spiked Seltzer generated excitement around a product launch by creating murals allowing passers-by to scan a QR code to watch a 3D vending machine where interactive animations come to life. The animations helped direct consumers to locations where they could buy the product nearby. We don’t know exactly how each of these campaigns performed financially for each company, but a recent survey from Havas stating that 84 percent of people expect brands to create content indicates that activations such as these are not only welcomed by consumers, but are anticipated to garner their engagement.

Unsurprisingly, one of the most popular uses of AR is social media filters, available across platforms including Instagram, Facebook, Snapchat, and TikTok. With users spending an impressive 75 seconds on average interacting with AR content, these filters are a powerful tool for driving engagement and brand awareness across platforms. By their nature, they require users to participate and share. Even five years ago, the Taco Bell Cinco de Mayo activation, a Snapchat Lens feature that turned users’ heads into giant tacos, resulted in more than 224 million views in one day.

The NFL recently partnered with Nickelodeon to virtually bring some of the channel’s signature slime onto the football field via AR.

Improving the Consumer Experience

AR can also help make customers’ lives easier in-store and post-sale. The 2019 Consumer Retail Technology Survey showed that 61 percent of consumers look for ways to save time while shopping, so retailers such as Lowe’s and Walgreens introduced AR indoor mapping. Shoppers can look up a product in their app, and arrows will then appear on screen to point them in the right direction. Post-sale, automakers like Hyundai and Mercedes shifted to AR-based user manuals, allowing drivers to scan an element of their vehicle and explain its functionality.

What’s Next, and How to Get There?

According to Grand View Research, the global augmented reality market is expected to expand at a compound annual growth rate (CAGR) of 44 percent by 2028 to hit $340 billion. In the face of such rapid growth, passion is the AR industry’s greatest asset. Consumers want to learn and experiment, and will look to retailers, manufacturers, and brands to give them an opportunity to do so.

All of these stakeholders are working on it, but making progress means working differently. Developers, retailers, and manufacturers are passionate about how they see the problem and how their AR solution addresses it, but it’s important to be wary of the “what comes first” scenario. Instead of thinking of steps to a solution in succession — technology first, then retail adaptation, or vice versa — we must think collaboratively. Developers, retailers, and manufacturers should experiment on a path forward together.

We’re now seeing how collaboration can propel adoption rates with augmented and mixed reality smart glasses. The enterprise and consumer worlds — across hardware, software, and services — are investing and have smart eyewear products in different stages of development. Some major use cases of augmented and mixed reality eyewear include remote worker enablement and industrial safety training. As a result, ABI Research reports nearly 28 million augmented and mixed reality smart glasses will ship in 2026.

One important way developers, retailers, and manufacturers can come together is to use our respective skills and reach to educate consumers. Mass education is what will lead to AR’s tipping point. How can we position it as a problem solver vs. a new technology that consumers may feel stressed about adopting? What use cases can we elevate to prove that AR isn’t just a trend? How can we collaborate with the passionate and the loud to influence the wider public?

The great news is that support is already abundant in the industry. Projects of all sorts — big or small, wild or conservative, unusual or expected — fuel excitement and progress. The viral popularity of Pokémon Go in 2016 was followed a few short years later by a $21 billion contract from the U.S. Army for AR glasses to help soldiers “fight, rehearse, and train” in one system. This move signaled both the legitimacy of the technology and the fact that it’s here to stay. When everyone, from the Dallas Mavericks to Snoop Dog to Ikea, is using AR, the public gets educated and excited.

If consumers understand that AR helps them make smarter buying decisions and save time, AR can also become a new way of shopping and living.

CE RETAIL TECHNOLOGY

August 2021 CE News

Amazon Stores Get a New Leader | Amazon has appointed Tony Hoggett to lead its brick-and-mortar business as senior vice president of physical stores. The retail veteran has spent the last 30-plus years with Tesco, the U.K.’s largest retailer, where he currently acts as the company’s chief strategy and innovation director. Hoggett will assume his position in January 2022 and report directly to Dave Clark, CEO of Amazon’s Worldwide Consumer Business.

Repeat Shoplifting Incidences Force Retailers to Rethink Store Operations | Organized crime sprees in the form of shoplifting have been popping up in major U.S. cities as worker shortages plague the country. Five Target stores in San Francisco have reduced operating hours as a way to get ahead of the profit losses and to ensure employee safety. The thieves often calculate the cost of their intended targets to ensure the items they are stealing fall below the felony threshold, so that officers cannot take action against them.

Retailers Welcome Child Tax Credits | Just as tax returns and stimulus spending offered some reprieve for retailers after a tough year, child tax credits are another welcome government initiative to continue the upward momentum. JP Morgan estimates that the monthly checks, which range from $250-$300 per child, will boost retail sales by 0.7 percent. Jim Sullivan, an economics professor at the University of Notre Dame studying the impact of the coronavirus pandemic on Americans living in poverty, told CNBC, “The retail sectors where middle- and lower-income families spend money are likely to benefit some from this.”

Consumer Prices Saw Biggest Spike Since 2008 | Prices increased 0.9 percent in June 2021, representing a 5.4 percent year-over-year increase and making history as the largest spike over a one-month period since June 2008. But unlike the “Great Recession,” which took place from late-2007 through mid-2009, consumers in 2021 are continuing to open their wallets. The reason prices are rising now is due to lingering supply-chain struggles brought on by the pandemic. The Biden Administration feels confident, however, that the inflation will taper off next year and into 2023, as supply and demand become more aligned.

Apple is Working on a Buy Now, Pay Later Option

Apple is leaning on Goldman Sachs in anticipation of a new “buy now, pay later” offering for Apple Pay purchases. The two companies have been working closely since the launch of the Apple Card credit card in 2019, but their latest venture actually won’t require the use of one. The project, internally coined Apple Pay Later, will allow purchasers the option of paying for items across four interest-free payments made every two weeks or across several months with interest.

AUDIO

Five Things to Listen for When Auditioning a Soundbar System

Focus on these evaluating elements to help your customers make the right choice.

BY PAUL HALES, President and Product Designer for Premium Audio Brands, Pro Audio Technology and Theory Audio Design.

So, you just sold your client the latest and greatest flat-screen TV. Now what? If your client wants better sound than TV speakers can offer – and they really should – the next decision is to decide between a soundbar or discrete speaker system. When it comes to sound quality, you can’t beat the soundstage and immersion of a good-quality 5.1 (or higher-channel count) system, but not everyone has the space or budget. The good news is that today, many of the latest soundbars offer high-end fidelity and aesthetics to match the latest flat-screen TVs, but don’t take up any floor space or break the bank. Whatever the case, it’s important that customers avoid blindly buying any speakers off the store shelf or online. Just like a car, TV, or other expensive electronics, audio is an investment worth testing out. The best way to help your client choose a soundbar system (or any loudspeaker system, for that matter), is to demonstrate different makes and models within their budget and then allow them to decide which they prefer.

My customers often ask me what they should listen for when auditioning soundbars and theater systems. In my opinion, when evaluating audio, it comes down to five different things to listen for. Here’s what I go over with them:

1. Naturalness

You should never be distracted by the sound of audio equipment. When listening to any kind of content, ask yourself: Does it sound ‘real’ to you? Is the sound balanced, with no emphasis on any frequencies – high notes, low notes, and everything in between? A good-quality soundbar system should sound like the real deal and make you forget it’s even there. It should never sound harsh, irritating, or distracting.

2. Detail and Resolution

Are the low-level sounds just as clear and intelligible as the loud sounds? Are the soft sounds audibly realistic, too? Can you hear the subtleties? Maybe it’s the flutter of an insect’s wings, a clock ticking on the far wall of the room, the nuanced texture of a delicately orchestrated score, or a car driving by outside. Just as in real life, you should be able to unravel low-level information in the background, not just what’s happening in the foreground.

3. Dynamics

Is there an easily discernable contrast between soft and loud sounds? This is an area where most audio systems falter. Real acoustic events such as the human voice, musical instruments, natural sounds like a breaking twig, or the slam of a book dropped on a tabletop contain a high level of acoustic energy when compared to silence (the absence of acoustic energy). We call the difference between the loud sounds and silence “dynamics.”

In real life, this rapid change from silence to sound gives these acoustic events life and snap, even on softer delicate sounds such as carefully plucked classical guitar strings. Dynamics give the sounds, even the softest ones, clarity.

When listening, ask yourself: When called for, does the system play both soft and loud with ease? Is the system still “lively”-sounding, even at extremely low listening levels? During loud passages, it shouldn’t feel like the speaker is pushed too hard or distorted, no matter what content you throw at it. And the soft moments should be just as engaging and lively as the loud ones. It’s thrilling to be engaged in a noisy action scene, but you should also be able to make out soft details and quieter dialogue without having to adjust the volume.

4. Bass Response

Can you feel – not just hear – the low notes in your core? In real life, the lowest-frequency sounds contain a lot of acoustic energy, causing us to feel as well as hear them. The right soundbar systems will ensure that explosions, double-bass notes in jazz music, and a jet engine flying overhead are visceral as well as audible. This tactile part of sound reproduction adds to the realism. And, most importantly, a good soundbar system should be able to reproduce those deep bass moments, effortlessly.

5. Immersion

Do you feel as if you’re in a real three-dimensional space? In real life, we experience sounds all around us, above us, and even sometimes below us. A good audio system should capture the “open” and “enveloping” qualities of natural sounds.

When listening to an audio system, does it seem as though all the sound is coming from one centralized spot (i.e., right in the middle, under the TV)? Or, is the sound “open,” and seems to come from wall to wall, floor to ceiling? Do any of the sounds seem to come from the sides, or even behind you?

With modern soundtracks, a good soundbar system can fully envelop you in sound, even with just three channels anchored to the front wall, causing you to forget that you are listening to audio equipment at all. The sound should not seem to emanate from the soundbar itself. Rather, it should feel unrelated to the soundbar and take on an open 3D quality that’s more like real life itself. It won’t seem as though you’re watching a movie or concert video; you’ll feel like you are in the scene of the film or at that live performance.

Choosing the right soundbar system is a very personal decision, and it’s important to allow your clients to try before they buy. A soundbar with the qualities described here will not only thrill them, but also transport them from their family room (or other space) right into the middle of whatever movie scene, video game, or live concert they are watching. The best soundbar system will do that for the listener every single time they sit down and turn it on.

UNBOXED

Starlink Has Potential — and Problems

Getting broadband Internet access to rural areas could be a boon to businesses and sales.

BY JOHN R. QUAIN

While Jeff Bezos and Richard Branson have been rocketing themselves into space, Elon Musk has been working on another space race. Launching thousands of satellites into orbit, Musk’s SpaceX is the first company to build out a low-earth-orbit high-speed Internet service dubbed Starlink. Intended to bring broadband to underserved rural areas, Starlink could potentially cover the globe.

However, after several months of testing, we’ve found that Musk’s service has more than a few kinks that still need to be straightened out.

Underscored by urbanites’ flight to the country during the pandemic, rural Internet access is lacking in many areas. Reaching individual homes miles from populated areas with cable or fiber optic lines is economically impractical, and cell towers are too few and far between for high-speed wireless. Enter the idea of low-earth-orbiting satellites.

How it Works

The Starlink plan is to use a constellation of thousands of satellites to deliver Internet service to remote areas at speeds of 300 Mbps or better. Unlike a HughesNet or DirecTV satellite, these are not geosynchronous or geostationary satellites, which typically sit in one spot about 22,000 miles above the planet. Starlink’s smaller satellites are not stationary and travel at about 340 miles above the Earth, substantially reducing the signal delay or latency.

Getting customers connected is still expensive. The Starlink package costs $499 for the satellite dish and a Wi-Fi router. Shipping and taxes put the initial total at $581.94 for our system. The service is also steep: $99 a month for unlimited Internet access.

On the other hand, the Starlink system is simple to set up. Push the dish’s pole into a supplied tripod, find an open piece of sky to aim at, string the cable to the included Wi-Fi router, and turn it on. The dish is motorized to make aiming adjustments, and heated to keep the snow off.

Whereas TV satellites require dishes in North America to be aimed at the southern sky, Starlink’s sats are currently clustered around the 49th Parallel, so its dishes have to look toward the northern sky and require an unobstructed view. That issue is made more problematic by the fact that the dish is restricted by an attached 100-foot cable, a length that will prove to be too short for many rural installations.

SpaceX is leveraging its experience in building rockets and spacecraft to deploy

the Starlink Internet System. (All images: Starlink)

Faster, With a Few Caveats

After months of hands-on testing as part of Starlink’s beta program, we found the technology delivers much faster speeds than rural DSL or traditional satellite service. We typically hit top download speeds of 200 Mbps and upload rates of about 40 Mbps. That’s hundreds of times faster than the 1.5 Mbps DSL connection in the same test location.

Unfortunately, Starlink suffers from millisecond dropouts, which kills video call services dead. Over countless Facetime, Skype, WebEx, and Zoom tests, calls would begin with broadband picture clarity, but within minutes, the Starlink dropouts would freeze the call. So while the service in its current form is fine for Web surfing and streaming 4K movies, which can be buffered, Starlink is not adequate for high-speed synchronous services like making video calls.

Starlink recently acknowledged some of these issues in a newsletter to subscribers. The company says as more satellites are sent aloft, reliability will improve. It also plans to fix its software so that the earth-based dishes can seamlessly switch to a different satellite in the event of a service interruption.

The Competition

The low-earth-orbiting technology still has lots of promise, so understandably there’s a lot of competition building in the Internet satellite space race. Amazon, for example, has plans for a similar service it calls Project Kuiper to deliver rural Internet access. Canadian firm Telesat has plans to bring similar services to maritime customers, and OneWeb in the U.K. wants to reach customers in the Arctic by the end of the year. And not to be left behind, the two Chinese companies, Hongyun and Galaxy Space, have their own low-earth-orbit initiatives.

As of July, Starlink had roughly 2,000 satellites circling the globe. SpaceX’s Falcon 9 rocket can put up 60 at a time, but it will take thousands more to deliver complete service. The company has FCC approval to put 12,000 satellites in orbit and applied recently to put up 30,000 more. In the meantime, Elon Musk has tweeted promises of 300 Mbps speeds and that the service may go live as early as August. Whether Starlink can cure its hiccups before then remains to be seen.

SUMMARY:

- Using thousands of satellites, Elon Musk’s SpaceX’s low-earth-orbit high-speed Internet service is designed to bring 300 Mbps or faster broadband download speeds to heretofore underserved rural areas.

- We found the technology delivers much faster speeds than rural DSL or traditional satellite service, but the initial setup and monthly subscription fee makes it a pricey option. We also experienced millisecond dropouts during video calls.

- The service is still in beta, and the company says many of these glitches will be ironed out as more satellites are launched, possibly as soon as August 2021.

Lessons on Digital Prioritization from Social Media Week

Social pros stress the importance of being selective and knowing when to say goodbye to profiles that no longer serve your brand.

One of the biggest misconceptions when it comes to social media is that, in order to achieve your brand’s full potential, you need to be active everywhere, all the time. As new social media platforms pop up on what feels like a yearly basis, brands are left questioning whether they should create an account to capitalize on new territory. But without taking a hard look at a few key factors, seeking to be omnipresent on social media can actually be one of the biggest recipes for failure.

Social Media Week Los Angeles was held as a virtual event from June 29 – July 1, 2021.

At Social Media Week New York earlier this year, Falcon.io’s senior strategist, Casper Vahlgren, referenced Reebok’s 2012 Facebook strategy as an example of how easily brands can go overboard with the number of accounts they have.

Almost a decade ago, the footwear and clothing company had a whopping 616 Facebook pages under its brand name. Not only was this approach putting a strain on the social team in charge of these accounts, but it was also confusing for consumers as well.

While this example may be extreme, it reveals to how all businesses have the potential to fall into the same social media black hole. The focus, instead, Vahlgren says, should be on long-term brand building.

“You don’t necessarily need to shut down profiles,” he says. “Just make a strategic choice around where to allocate resources.”

Setting realistic expectations around bandwidth and budget is an important first step and one that Alec Johnson, social media analyst for TikTok, touched on in his Meetup at Social Media Week Los Angeles in June.

Casper Vahlgren, Senior Strategist for Falcon.io, discussed selectiveness and prioritization as it relates to brand strategy at Social Media Week New York, held May 4-7, 2021.

Some brands have the capacity to assign one person (or even a team of people) to manage a single social account, while other brands may not have the same luxury. But that’s not to say a team can’t see some sizable organic growth with little to no budget — a feat that starts with knowing how to prioritize.

When investing money into social media is not a possibility, investing time into the right channels is the next best option. Having three strong profiles where your audience is most active is a million times better than having 10 different accounts that are inconsistent and lacking character.

The next step is to analyze and identify opportunities for growth (or lack thereof) to make an informed decision on when to create or and when to deactivate a social media account.

Coco-Cola took the latter approach, after data revealed that half of its 400 brands accounted for just two percent of its total revenue. CEO James Quincey decided it was time to cut back, and in doing so, Coca-Cola was able “bring stronger innovation to the table.”

Brand and platform leaders, digital marketers, and social media practitioners came together at Social Media Week Los Angeles to unpack the 2021 theme of “Reinvention.”

RETAILER ROUNDUP

Countering COVID’s Domino Effect

The pandemic’s impact on chip supplies has caused seismic shifts in inventories, but retailers are meeting these challenges with customary toughness and ingenuity.

COMPILED BY NANCY KLOSEK

Dealerscope: How is the global chip supply shortage situation tracking these days relating to the consumer electronics and/or major appliances product categories? Which categories are hardest hit? What is the most disruptive aspect of this situation: product supply or product pricing hikes (or something else)? When do you expect the situation to improve — later this year, or not till 2022?

Jon Abt | Co-President, Abt Electronics & Appliances, Glenview, IL:

It is getting rougher. Seems like each day, we hear news of it affecting a new product segment. Of course, it’s expected in consumer electronics like computers or smartphones. But now it’s causing shortages in everything from microwaves to dishwashers. So many appliances today are smart — there’s a computer chip in just about everything. Unfortunately, there’s no indication that it will improve any time soon. We’re hoping the constraints ease sometime this year, but info coming in keeps changing.

Tom Campbell | Chief Technologist, Video and Audio Center, Santa Monica, CA:

There are a number of issues at play. When COVID first hit, our founder, Joseph Akhtarzad, thought there might develop a huge pent-up demand. So he opened up additional warehouses and we stocked up very heavily. So that’s helped us. But there have been shortages, for a couple of reasons. One is the demand on the chips – the automotive industry, as you know, uses a lot of chips. And sales of TVs and appliances have been way beyond expectations. So demand has driven chip prices up. And that’s affecting more of the entry-level products. Another thing is that we’ve been told that docks operations are looking for workers – there’s a shortage. In Long Beach [Calif.], at the ports, the containers have been stacked up sky high. So it’s not just the making of the products but it’s also getting them delivered. That’s been another challenge. So we’re telling people they should really be buying now, because we think prices will continue to go up for at least another year, at least until the chip shortages abate. There are more chip factories opening up to try getting ahead of the curve but it can’t be done overnight. We are getting product, but it’s a challenge.

Bob Cole | Founder/CEO, World Wide Stereo, Montgomeryville, PA:

The chip shortage is a drag. To some degree, it affects us with receivers… Preamplifiers and music streamers were also affected.

A lot of it has to do with supply and demand, and the demand is so high, they can’t keep the supply up. My biggest concern is that it hinders innovation; they’re so busy trying to fill orders with the current stuff, there’s been a slowdown in new, innovative products, in my opinion. But then again, [vendors] find better, more efficient ways to manufacture.

COVID is a very big piece of [what’s coloring] this demand. On some level, the bar is lower – [consumers have been] almost used to not getting what they want [due to backorders and shortages], especially at the beginning. It was really hard to get product, and everything was slow. People may have wanted a particular product, but we didn’t have it and they asked, ‘Well, what do you have?’ and they bought it. In many cases, that was great for us, because we sold a lot of stuff on hand. Someone wants to spend $500 or $600 for a receiver, and you don’t have anything under $1,000 — and they take it.

I think [supply] will be better by the holidays, or maybe not till next year. I believe demand will continue to be very high — it hasn’t been high like this since the ’80s.

Eden Goldberg | Vice President, Marketing & Business Development,

InMotion Entertainment Group, Las Vegas, NV:

We are seeing some product launch delays in terms of supply, and a couple of partners have spoken of possible price increases.

Eddie Maloney | President, Cowboy Maloney’s, Jackson, MS:

It’s affecting both CE and appliances. Everybody sees it, and knows there’s a shortage of product. We have people come in, and they say that some places they’ve gone, they didn’t have anything to sell. These are big boxes. The chip shortages affect a lot of things. Even though most of your major [appliance] brands are made in the U.S., they depend on chips and parts from all over the world, and when that supply is hurt, they get hurt.

One thing that’s changed for us [with buying] is that we don’t call up and ask for a specific model; we call up and ask for categories. And when product categories become available, we purchase them, even though we may already have a decent supply. At least in the last 14 or 15 months, we’ve been taking most everything the manufacturers have. There are some positive sides to it, as far as our company goes — and probably for a lot of other mid-sized retailers. Your big-box stores are focusing more on [allocating for] their bigger locations — not on Mississippi… So we’ve been very fortunate to be able to have more inventory for sale than the big boxes. The other thing is, with manufacturers having a hard time supplying merchandise and the big boxes having a hard time [getting] merchandise, we’ve seen a stabilization on pricing — nobody’s out there promoting the deep discounts which our industry is known for, because there’s no reason to discount things you can’t get [enough of]. If I can deliver it today, and they can’t deliver it for two months, I don’t care what they’re selling it for…

I’ve been in this business, now, for 50 years, and at Cowboy Maloney’s, next year will be our 70th year. As for the last 18 months, I’ve never seen anything like this, ever. But it looks like it’s getting better; there are signs of that, after its having started in April or May a year ago. But I think it will be 2022 before things catch up… We’ve always advertised models and price, but now, we’re advertising that we have inventory. We’re advertising our terms and that we’re getting inventory every day, but we can’t go specific on products, because by the time the customer comes in, we may be out of it.

It’s more broad promotion.

Ron Romero | Owner, Schaefer’s TV & Appliance, Lincoln, NE:

The chip shortage has just devastated the appliance industry with availability. We have so many products on backorder. I had a semi truckload of washers ordered for some time and I was told they’re sitting here, ready to go, as soon as they find the chips to put into them. That’s just one example. Everywhere I turn, most of our products, be they electronics or appliances, have some sort of chip issue. We have an appliance repair department, so to compound that, is parts availability — we’re struggling to get parts. If someone bought a washer six months ago and their control board goes out, we’re having a heck of a time finding one.

We have been getting stuff in, but not nearly what we need. Personally, I think it will take well into next year [to resolve], and I don’t know what it will take for [chip] manufacturers to gear up; they make semiconductors for so many industries, so who will get priority? Couple that with anything we’re buying from overseas in containers is slowing up, because of the containers shortage and a backup at the ports. It’s been a struggle. For independents like us, we’re doing what we can to buy what we can and are trying what we can. The technologies today lean so heavily on microchips that everyone’s being affected. It could be a low-end appliance to a high-end one. Compound that with the backup at the ports, and it’s really a juggling act.

Debbie Schaeffer | CEO, Mrs. G Appliances, Lawrence Township, NJ:

We don’t usually talk about [appliance] chip shortages in our industry, but I wrote a blog recently that sums it up. I call it the perfect storm — delays in the production lines, delays in parts, the containers shortage – I am hearing more about the container shortage than the chip shortage. Not only container shortages, but the cost of containers has just skyrocketed. And as for what did get into containers, there’s more time spent waiting to get it into the ports. It’s a domino effect, and it’s still ongoing. Honestly, it may still get a little worse as demand increases due to consumers’ pent-up purchasing desires. People are realizing there is a shortage; before, consumers didn’t, and they’re thinking, ‘My washer hasn’t been working really well and normally, I’d wait till it dies, but I’ve heard about shortages, so I’d better order it now in case it won’t be available when I need it.’ It’s almost like a pre-replacement-cycle purchase. If your washer goes, you would normally replace it in a day or two. How can you do that if you want a particular model and size — and especially, if you want a washer/dryer pair that matches? My blog recommends that consumers become knowledgeable about what’s going on, do their research early, and make those decisions, and not wait till the last minute. It’s the same for the kitchen as for the laundry room. We don’t know how long this will go on. It has been a challenge knowing when products will be available; it’s across brands and categories of products.

Aaron Sholtis | CEO, HiDEF Lifestyle, Harrisburg, PA:

Product demand has been outpacing supply for all of 2021 in audio, furniture, and networking. Chip shortages are the primary factor in audio and networking, while demand and COVID restrictions are also factors.

Sam Yazdian | President, Electronic Express, Nashville, TN:

The chip shortage is affecting everyone in our category. Appliances have really been hit hardest. Computers and gaming products are affected as well, and right now, the ETA (estimated time of arrival) for some appliances is 2022.

Every aspect of business is affected — even small appliances like coffee makers. All of them have chip sets in them, and when manufacturers can’t get them, they can’t make the products. You can’t really put your finger on any one category. Then, there are the supply-chain issues, on top of chip shortages. Every product being imported is impacted because there aren’t enough truck drivers to bring them from the ports. For some products coming from overseas and China, there are not even containers available to load them into. Something is always affecting something else. It’s going to take some time for the supply chain to get back to normal. I think by mid-2022, hopefully, it will be resolved.

Dealerscope: Now that we seem to be moving into a post-COVID mode in the country, are you seeing any additional shifts in consumer purchasing behaviors – both in the types of products they are now gravitating to, and in their choice of how to shop for them (is there still a gravitation to online purchasing as opposed to coming into stores)?

Maloney: It’s amazing. We’re picking up a lot of customers now because we have had merchandise that other people haven’t. But the other area of our business that is just unbelievable is new-home construction and remodel. Those products are backed up months and months, because everybody hanging around their houses [during COVID] had decided they either wanted to move or re-do their kitchens. In certain product categories, we may be six months out [on availability]. And that’s never happened in my years in this business. Being a month out would be a long time in our business… I have people calling to order specific refrigerator models, and I can’t help them. But we have been very fortunate that our building and remodeling business [categories] have been great, and we’re doing probably a better job of getting merchandised than most, but we’re still behind, with a lot of merchandise still “on order.”

But you know, people are not spending money on travel, on restaurants, and not spending disposable income on things they’re used to spending it on — they have more money than in years, and also the government [stimulus] help. I have good friends in the car business and they’re having trouble keeping cars in stock. There is a lot of money out there. I hope and believe it’s getting better.

Romero: Buying has spiked online; we’re noticing [a spike] here locally as well. During the pandemic, people just didn’t want to go out and shop, so they went to online. We have an online chat set up, and that was pretty seamless. But now, compound that with availability issues, you really need to talk to the customer to find out what their real needs are so that you can see what you have that will work for them. You have to say what you have in the range of what they need. Online business during the pandemic helped, and honestly, our business was up during that time. So we didn’t see any downturn – in fact, we saw a spike. People were buying appliances and TVs and wanted to upgrade their kitchens and laundry rooms, and were cooking more, so were more apt to shop and buy, and that’s still the case. There’s pent-up demand, but we have just so many products. It’s very challenging.

We’re a heavily promotional company, so to put together a price-point ad is almost impossible, because you may not have enough of this or of that. So we have to get very creative on how we are promoting, and get away from promoting the price, and rather, promote the features, benefits and advantages of shopping with our company. Price-point advertising is on hold right now. Also, for example, in stock now, we have a good inventory of washers across brands. But when it comes to dryers, we’re limited. And that’s across the board as well. So to advertise a washer/dryer pair is really hard to do. We have a lot on backorder right now, and we do have a good inventory, but the mix is thrown off.

Schaeffer: No question [that there are shifts]. When COVID happened, everybody wanted a freezer – you couldn’t find one for the longest time because customers were all staying home, cooking more, and needed the extra food storage capability because they didn’t want to shop that often at the grocery store. For us, now, they are available, but what might be available to us may not be available in other parts of the country. What we’re seeing here [in Central New Jersey] is that people hadn’t been eating out or traveling, and had been saving their money during COVID. And a lot of these customers have a great deal of equity in their homes. With the lower interest rates available to them, they can pull out that equity and make improvements and renovations. They’re doing new kitchens, doing new laundry rooms, doing outdoor kitchens — and they’re letting workers back into their houses. A lot are coming in, in the last couple of months. During the height of COVID, it was all about replacement appliances. New construction stopped, the wholesale business slowed, but replacement business still went on. Now, there’s still replacement, but I feel that because of pent-up feelings and extra available savings, people are spending. They are re-doing kitchens, laundry rooms — and even fixing up a really nice home office. Under-counter refrigerators, coffee-making systems and microwave drawers are going into those home offices.

By replacing a four-piece appliances package in a kitchen without even replacing the cabinets or countertops sometimes makes the kitchen look brand new. I always tell people to wait a bit before considering changing countertops and cabinets until you do the appliances.

Campbell: To some degree there are shifts. Streaming is red hot. And because of that, consumers now want the bigger TV screens. And even though prices have gone up in some instances, you can still get an 85-inch television now for a very reasonable price, where before you had to spend anywhere from $12,000 to $15,000. The other thing is features – sets are edge-to-edge pictures, almost without a bezel, and speakers are built into the screen, or you use a soundbar. So you can put a 75-inch in the same space were you had a 65-inch — the starting sizes for the main viewing areas in the home are becoming larger than ever for buyers.

Yazdian: It works both ways. Customers shop digitally online, and if you have the merchandise they pick it up or it’s delivered. Now people have been buying the larger TVs during the pandemic because they are home and want a better viewing experience. For the time being, that should continue. To see when behaviors will be back to normal, it may depend upon the part of the country you are looking at, and the degree to which people are vaccinated in each area, and when things open up. It all depends on the industry you’re in; working from home is great for some industries, and not for others.

In our brick-and-mortar business, we’ve seen the traffic pick up. We keep promoting buy online, pick up in store (BOPUS). If they don’t want to pick it up, we deliver. I think this trend will continue because of the ease of the shopping experience, like for smaller items that they can buy online, and it is a way around having to pick up certain merchandise. If it’s a larger item, they will probably come to the brick-and-mortar stores. We have customers that go online, do their homework, narrow down what they want, and when they come here, it’s a faster, easier transaction. A lot of it also depends, too, on what you have in stock.

Outdoor-related products have been really good [sellers] — things like outdoor speakers, because everyone’s been confined to their homes. Also, things like projectors and outdoor screens have done well, for movie nights with neighbors, and also grilles and things like that.

Sholtis: Store traffic is up, but online and installation are far eclipsing retail sales. All products for the home are selling extremely fast — especially theater, audio, networking, and office furniture. We expect light commercial to pick up in the third and fourth quarters, as people continue to return to their offices, etc.

Cole: Some things occurred with COVID. People learned how to be Millennials – learned how to buy online, which was great for ecommerce, which is really the velocity of our industry these days. The other part is, people my age also realized the frustrations of buying online.

People were digging into their homes and realizing they needed a better network, which accounted for a huge rise in our business. They were staying home, weren’t going out to dinner or on vacation, so their budget was higher and it was almost, ‘I don’t care what it costs.’ And there was always a sense of urgency, which was a problem – ‘I want that theater next week.’

What else happened was that people discovered that being at home with family can be pretty nice. The whole ‘man cave’ thing — I hate that term — evaporated, and it became about the family. It was one reason we’ve been so successful.

I think that’s a COVID triumph. And I don’t see that going away that quickly.

I feel good about that — and it was one of the factors I’d been looking at very closely this year. Two years ago wasn’t the best year for World Wide Stereo [due to Amazon]. But last year, when COVID hit, business went through the roof. Even when we closed the stores for six weeks, I had four retail sales staff who refused to be furloughed; they said we’ll just call people. And they did Christmas numbers. And people were thrilled when they got the call, for the most part – a common response. They perceived the call as thoughtful – ‘Indeed, I can do with two more TVs, and the kids are home and we need a better network…’ It was a shopping list.

With our online chat, one of our guys handling that averaged $20,000 in sales a day, on his day off, just chatting and working his phone. In fact, one of his customers who wanted a TV and asked how to make it sound better ended up buying a $120,000 theater — [sold] on his phone, from a chair. There was that discovery, you know.

People always just want an excuse to buy a Ferrari, if they can possibly afford it — that’s what I always tell my sales guys. But in lieu of a Ferrari, make them feel like they’re buying a Ferrari!

ABT: People continue to buy in record numbers. Early on in the pandemic, there was a dramatic spike in the obvious categories: technology for working from home, bread makers, air purifiers. But in the last 12 months, we’ve seen increases in almost every product category. Appliances continued to perform well over the summer. And we’re now seeing a nice lift in categories that were all but decimated last year, like luggage.

And in-store shopping is more or less back to pre-pandemic levels. With Illinois now fully opened, we’ve restarted many of the in-store experiences that were closed all last year. Cooking demos, fresh-baked chocolate chip cookies on the weekends, interactive displays for kids, things like that.

Goldberg: Thankfully, there is a strong desire for travel, and the airports and resorts are bustling. We are catering more to leisure travelers as well as travelers’ intent to work from anywhere. The needs have evolved and the solutions we provide are therefore adjusted. We are always intent on being a solution for any traveler, and now we offer bundled solutions customized for each traveler.

Dealerscope: Which aspects of the business booms that manifested themselves due to working-from-home behaviors during COVID will continue past the COVID crisis (i.e., increased large screen TV sales, etc.)? Which do you think won’t continue?

Cole: I do believe this will continue — 2020 was up significantly over 2019. We’re busy in all categories, online. And in our custom integration business, we’re [very busy and] telling people we can’t install their system till September. But what we’ve noticed is that people, rather than running out and trying to find someone else not as good, are happy to wait for a premium experience. I don’t see that going away — nor do I see any of this boost in business going away before maybe next spring, if it ever goes away.

ABT: We believe that appliances will continue to flourish. Home gym sales are still strong. I don’t think that everyone wants to go back to the gym yet, whether for safety issues or because they’ve come to prefer the convenience of working out at home. Home office continues to be strong, as WFH [working from home] has become a permanent option for many. One notable slowdown is freezers. I don’t think consumers are worried that they need to hoard food anymore.

Sholtis: We expect that purchases for staycations and improving home networks will continue to grow, long term. Online and custom installation will continue to be strong as well. TVs over 80 inches will continue to be our biggest seller, but we don’t believe they will continue to grow past that size. Renewed interest in projectors and especially short-throw projectors will continue into 2022 and beyond.

Dealerscope: Do you expect the stay-at-home work habits could revert to pre-COVID work patterns/habits? Or will it be a mix of the two, as something unique and born out of the “new normal”?

Maloney: I think it will be a mix. We’re looking forward to having our [buying group] meeting in September… everybody wants to get back out and see people and talk to them, and network with other members and find out what’s going on with them, but it could be a lot more online meetings.

Sholtis: We believe it will certainly be a mix of the two. Someone wise said that major events in society, like COVID, typically don’t change the trends in commerce, they only accelerate them. Working remotely was a trend well before COVID hit, and I expect it was only exaggerated by the effects of the pandemic. Businesses and employees have learned, adapted and have become comfortable with the new normal of working remotely when possible.

Yazdian: I think these behaviors will continue this year, supported by stimulus money and tax credits consumers are getting. Then it will go back to more normal behaviors in late 2021 and early 2022. They are doing financing, but at some point, they will exhaust these avenues. People have been reinvesting in their homes. That’s one of the reasons major appliances and TVs are selling so well — and also part of the reason for some backorder situations. It’s been a bit of a domino effect. Also, there are a lot of new homes being built in our area, and new apartments – and hopefully, whoever moves there will want to buy a TV.